Data Breaches Result in Painful Forecast

Table of contents

Potential lost equity from a data breach

CFOs and CISOs have the painful task of forecasting and communicating data breach losses to their CEOs and Board members. This is a particularly complex endeavor given 26% of companies are repeatedly victimized, including enterprises like: Amazon, Facebook, and T-Mobile USA.

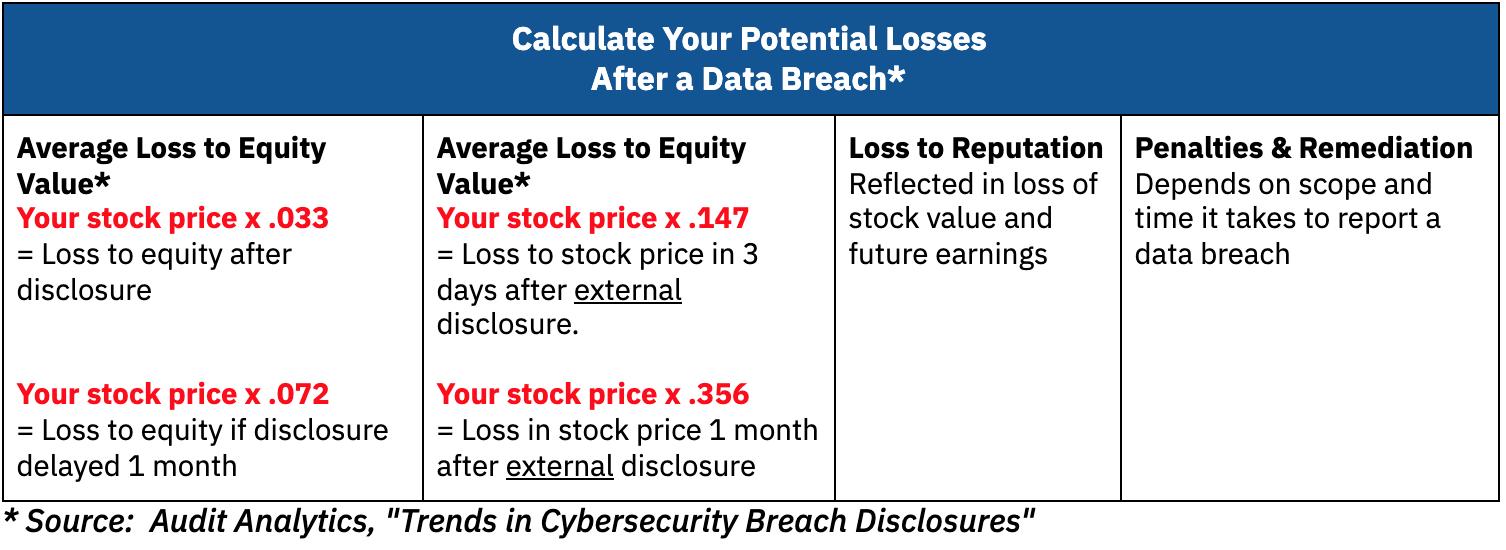

Calculate your potential losses

Enterprises routinely forecast earnings, risk, and potential losses. To forecast potential losses caused by data breach, requires quantifying each type of loss. Companies often categorize these losses after a data breach. Below are the top 3 loss categories.

- Loss of equity value

- Loss to reputation

- Cost of penalties and litigation

Let’s examine each loss category — both the short and long term impacts.

LOSS OF EQUITY

The longer it takes to report a data breach, the greater the loss of equity to an organization. According to the report from Audit Analytics, on average:

-

- 108 days pass before companies discover a breach

- 49 more days pass before companies report it

To estimate the potential loss of equity value caused by data breach, calculate as follows:

-

- If immediate disclosure: multiply your stock price by .033

- If disclosure is delayed a month: multiply your stock price by .072

When the data breach is discovered externally and reported, the losses increase. Scroll down to see the average lost percentage of stock price if a data breach is reported by company versus by external sources.

LOSS OF REPUTATION

Many businesses are built on a brand. To forecast the potential damage to a company’s brand is difficult. For indicators of loss, use your estimates for forecasted loss to equity and business. Some enterprises also include estimates on acquisition cost to replace any lost customers, as well as the lost lifetime customer value.

PENALTIES & LITIGATION

Penalties and litigation costs vary, but are highest in regulated industries. Other factors to consider are the scope and time it takes to report a data breach. Recent penalties include:

-

- British Airways = £20 million

- Uber = $150 million

- Equifax = $575+ million

- Capital One = $80 million

- Target = $18.5 million

- Anthem = $16 million

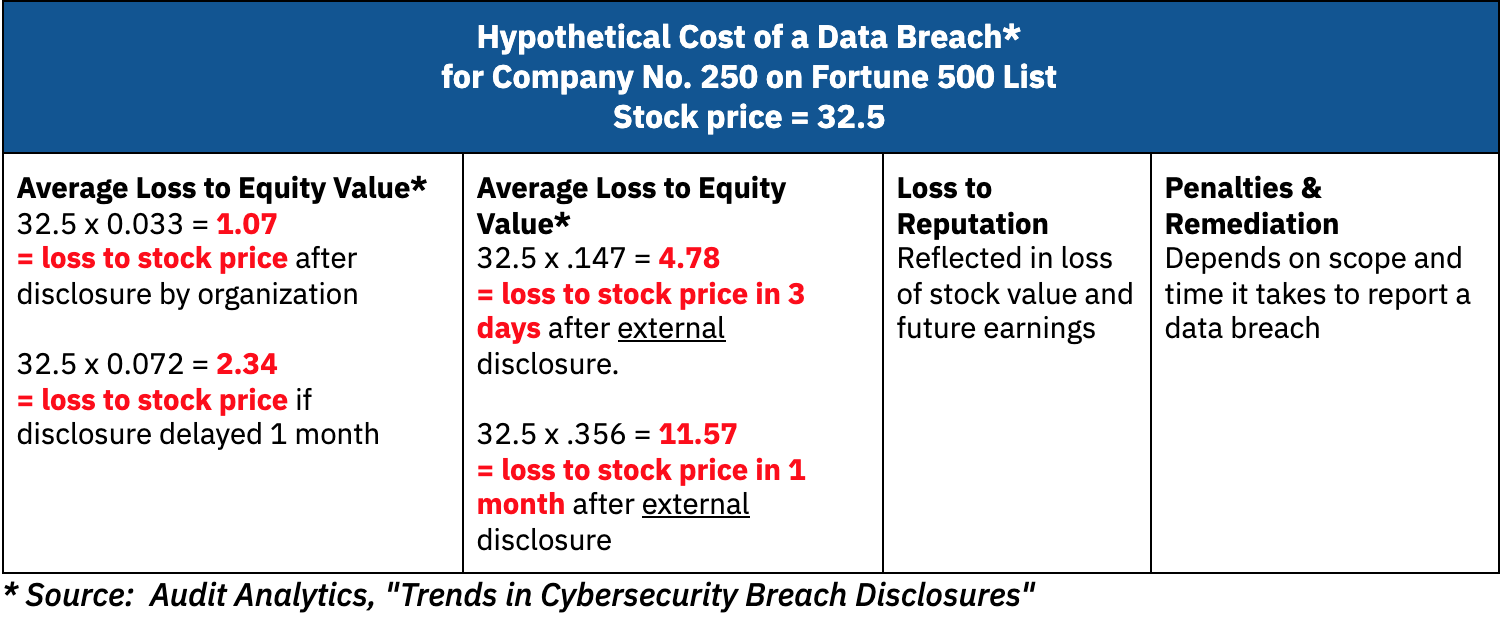

Use the chart below to calculate your possible losses after a data breach.  For example, we will use the real stock price for Number 250 on the Fortune 500 list of top-earning companies in the USA. If this company had experienced a data breach in 2019, these are estimates of typical average losses.

For example, we will use the real stock price for Number 250 on the Fortune 500 list of top-earning companies in the USA. If this company had experienced a data breach in 2019, these are estimates of typical average losses.

Cost of a Data Breach versus cost of a Data Leak Platform

Now that you know how to forecast potential losses from a data breach, it is simple to calculate the return on investment from using a data leak platform. The CybelAngel digital risk platform prevents data leaks from becoming data breaches with an average first year ROI of 2.3. If you want to compare your cost of a potential data breach with the cost of a data leak platform, contact us for pricing.

Minimize your losses

CybelAngel enables companies to protect against data leaks becoming devastating breaches. We use advanced machine learning to detect leaks of customers’ sensitive data. Our digital risk platform scans for confidential and proprietary data and its location, instantly alerting our clients when their sensitive data is at risk. To fix data leaks, our clients take action internally or rely on CybelAngel’s security experts to resolve the risk. Learn what and where your data is leaking, including: # of exposed documents, open servers, and leaked employee credentials. Get your complimentary assessment Data Exposure Dashboard. Because data leaks are inevitable; but damage is optional.